2025 Federal Energy Tax Credits

2025 Federal Energy Tax Credits. The tax credits listed below became available on january 1, 2023 and can be claimed when you file your income taxes for 2023. The maximum credit amount is.

If you don’t qualify for energy efficiency. August 4, 2023 tax credits.

Americans Who Installed The Following Technologies In 2023 Can Claim Credits On Their Tax Returns Due On April 15, 2025:

How to make the most of energy efficiency tax credits in 2025.

Investment Tax Credit And Clean Energy Investment Credit.

Simple tax filing with a $50 flat fee for every scenario.

The Tax Credits Listed Below Became Available On January 1, 2023 And Can Be Claimed When You File Your Income Taxes For 2023.

Images References :

Source: www.energy.gov

Source: www.energy.gov

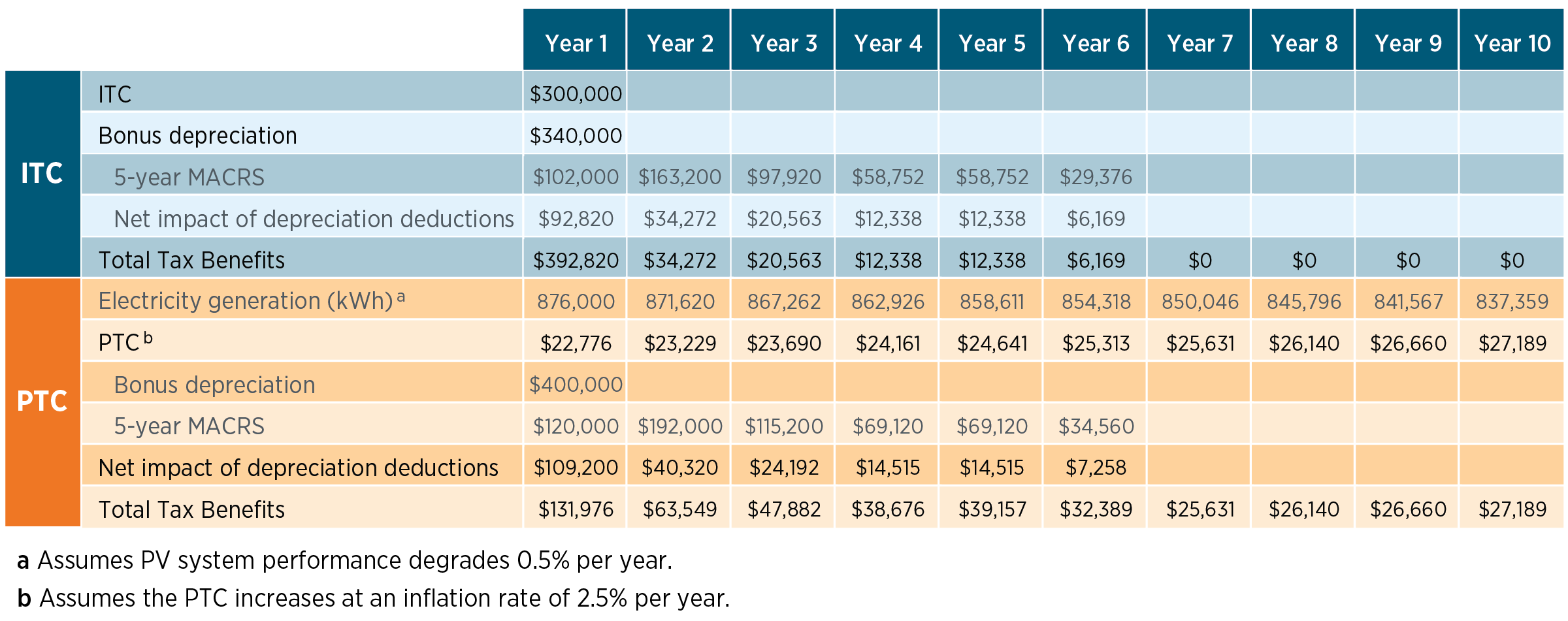

Federal Solar Tax Credits for Businesses Department of Energy, Changes enacted as part of the inflation reduction act allow companies to. Tax credits generated from clean energy projects are projected to reach $50 billion in 2025 (see credit suisse:

Source: nrgcleanpower.com

Source: nrgcleanpower.com

Solar Tax Credit What You Need To Know NRG Clean Power, The tax credits listed below became available on january 1, 2023 and can be claimed when you file your income taxes for 2023. Tax credits to other companies now account for a market worth between $7 billion.

Source: www.energy.gov

Source: www.energy.gov

Federal Solar Tax Credits for Businesses Department of Energy, If you don’t qualify for energy efficiency. Tax credits generated from clean energy projects are projected to reach $50 billion in 2025 (see credit suisse:

Source: simpliphipower.com

Source: simpliphipower.com

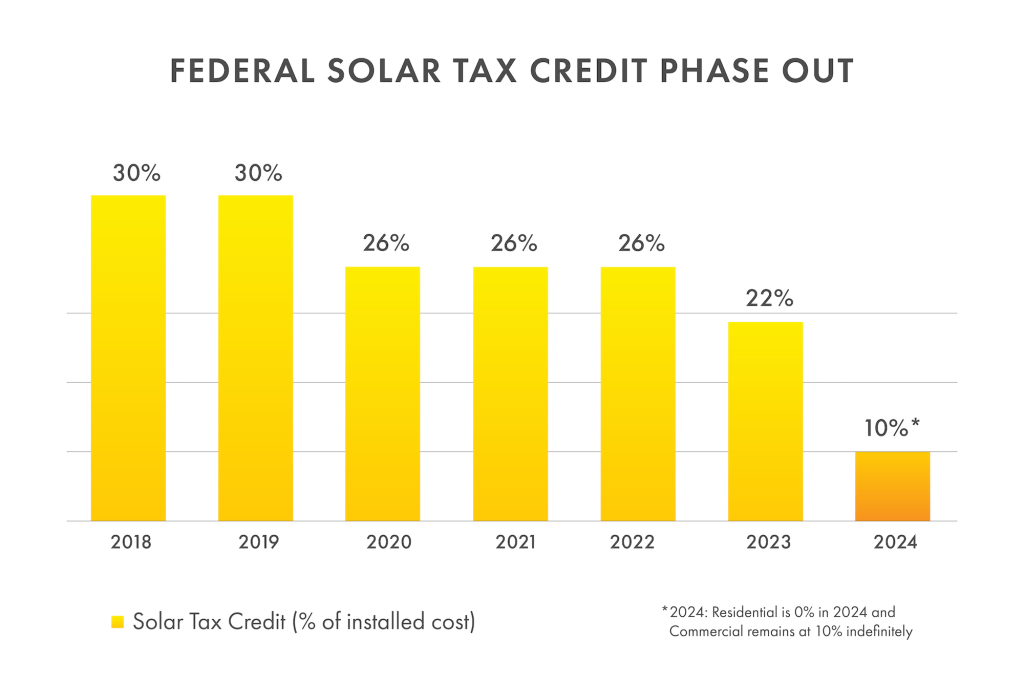

Final Days of the 30 ITC Solar and Energy Storage Tax Credit Briggs, What is an energy tax credit? What are the energy tax credits for homeowners?

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

Clean Energy Tax Credits Can’t Do the Work of a Carbon Tax Tax Policy, Tax credits to other companies now account for a market worth between $7 billion. Summary of federal tax credits for hydropower and marine energy.

Source: www.solar.com

Source: www.solar.com

How to File the Federal Solar Tax Credit A Step by Step Guide, If you don’t qualify for energy efficiency. The energy efficient home improvement credit can help homeowners cover costs related to qualifying improvements made from 2023 to 2032.

Source: haleakalasolar.com

Source: haleakalasolar.com

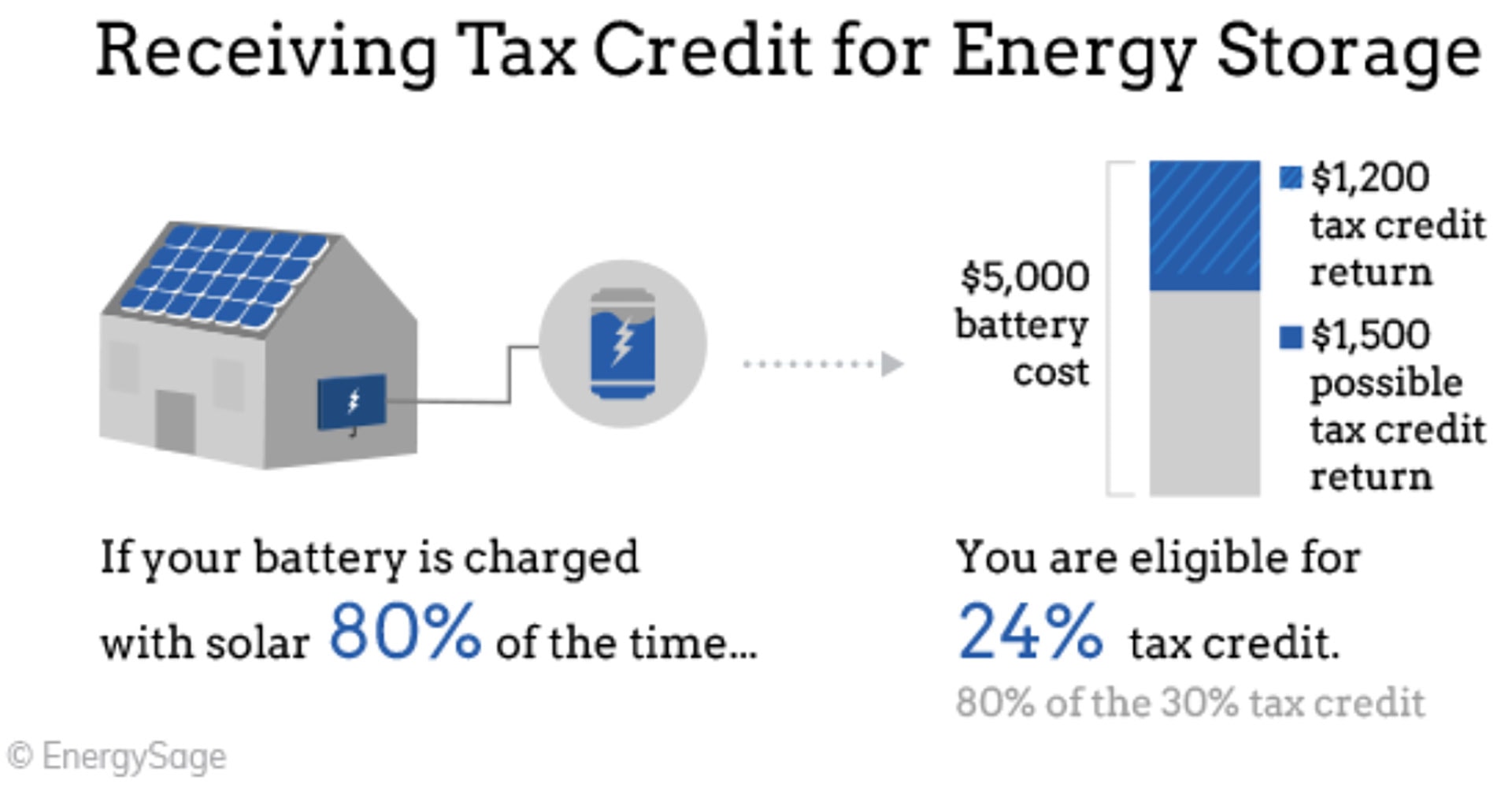

Government Rebates for Solar Panels Haleakala Solar Hawaii, What is an energy tax credit? Therefore, if your solar panel and battery system.

Source: a1asolar.com

Source: a1asolar.com

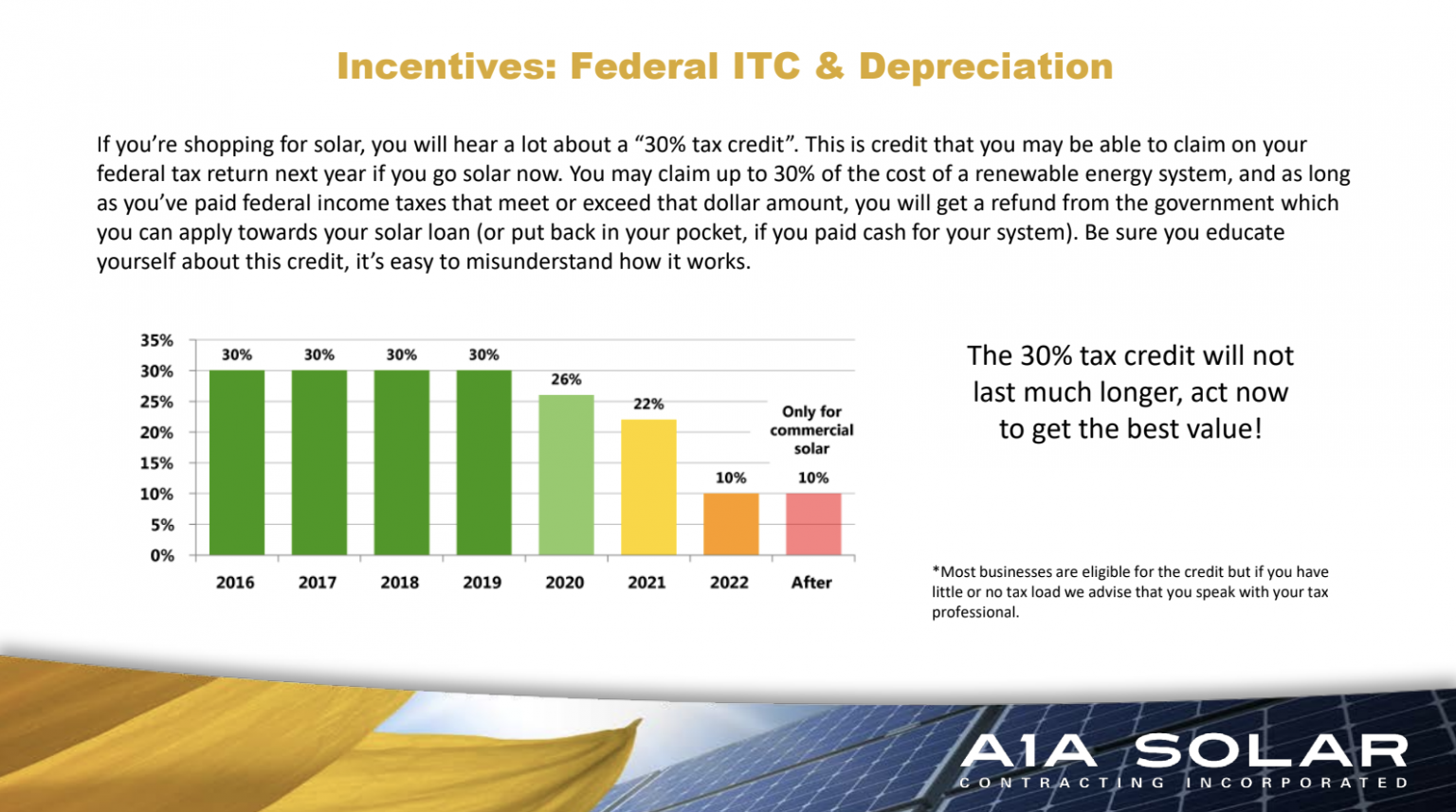

Get a 30 federal tax credit for your solar panel system while you can, Department of energy (doe), the u.s. Americans who installed the following technologies in 2023 can claim credits on their tax returns due on april 15, 2025:

Source: geoscapesolar.com

Source: geoscapesolar.com

Determining Eligibility for the Solar Investment Tax Credit Geoscape, In 2025, homeowners purchasing a solar energy system may be able to claim a tax credit worth up to 30% of project costs. If you don’t qualify for energy efficiency.

Source: www.bdo.co.za

Source: www.bdo.co.za

Unpacking the new solar energy tax credit BDO, In 2025, homeowners purchasing a solar energy system may be able to claim a tax credit worth up to 30% of project costs. The energy efficient home improvement credit can help homeowners cover costs related to qualifying improvements made from 2023 to 2032.

Brasher Paul Schockett Kate Mathieu.

The energy efficient home improvement credit allows you to claim up to 30% of the cost of eligible expenses, with a total annual cap of $3,200.

The Tax Credits Listed Below Became Available On January 1, 2023 And Can Be Claimed When You File Your Income Taxes For 2023.

With nerdwallet taxes powered by column.